A Deep Dive into the Global Startup Ecosystem Index 2024. And a little bit of added positive trends from another report by Startup Genome called Global Startup Ecosystem Report 2024.

As the sun sets on the first quarter of 2024, the global startup ecosystem finds itself in a state of flux. The recent reports presents a comprehensive analysis of the current state of startups worldwide, offering a detailed look at funding trends, industry shifts, and the positions of various countries and cities in the entrepreneurial hierarchy. Here we explore these dynamics, with a particular focus on the European landscape, and delves into the performance of Portugal in comparison to its neighboring countries, Spain and France. We will also reflect on Portugal’s journey over the past year to understand how the country’s startup ecosystem has evolved.

The Global Startup Funding Landscape

A Downward Spiral in Funding

The startup funding landscape has experienced significant turbulence over the past few years. Following a record-breaking year in 2021, where global startup funding reached a staggering $190.5 billion in Q4, the market has since seen a dramatic decline. By Q1 2024, total funding had plummeted to $66.1 billion, marking one of the lowest levels since early 2018. This downturn is not confined to a single stage of investment but has affected early-stage, growth-stage, and late-stage funding alike.

Early-stage investments, in particular, have borne the brunt of this decline. Founders are now urged to shift their focus from blitzscaling to achieving early revenue, a strategy adjustment necessitated by the harsh investment climate. This new reality is reshaping how startups approach growth and sustainability, emphasizing the importance of building a strong financial foundation before scaling operations.

The Rise and Fall of Unicorns

Unicorns — startups valued at over $1 billion — have not been immune to the funding crisis. While the creation of new unicorns has slowed significantly, the existing ones are grappling with declining valuations. From November 2023 to April 2024, the number of new unicorns remained in the single digits for six consecutive months, a stark contrast to the boom of 2021 when the number of unicorns surged by over 200%.

Moreover, many unicorns are teetering on the edge of losing their status. As of April 2024, 45% of unicorns are just a downround away from falling below the $1 billion valuation mark. This precarious situation underscores the vulnerability of high-valuation startups in a volatile funding environment.

Industry Trends and Economic Shifts in the Global Startup Ecosystem according to both reports

Artificial Intelligence (AI): The Vanguard of Innovation

Artificial Intelligence continues to dominate the startup landscape, with significant advancements and widespread adoption across various sectors. In 2023 alone, startups embedding AI into their business models raised nearly $50 billion, making AI the top-funded industry. This trend shows no signs of slowing down, with Q1 2024 seeing a modest 4% increase in AI funding, maintaining a streak of five quarters with funding levels above $10 billion. The rapid evolution of AI technologies is exemplified by OpenAI’s GPT-4, a multimodal model capable of processing text, images, and audio inputs with near-human-level performance. This breakthrough has propelled AI into mainstream use, with applications like ChatGPT, Midjourney, and Lensa becoming integral to both business and everyday life.

Healthtech: A Post-Pandemic Resurgence

The Healthtech industry, which saw explosive growth during the COVID-19 pandemic, is experiencing a resurgence. Q1 2024 witnessed a 48% increase in Healthtech funding compared to the previous quarter, alongside a near doubling of mergers and acquisitions in Q4 2023. This renewed interest is driven by innovations in areas such as weight-loss medications and neurotechnology. Neuralink’s successful human implantation and subsequent $323 million funding round highlight the significant advancements in neurotechnology. The industry’s venture capital investment surpassed $8 billion in 2023, marking a 100% increase from previous years. These developments underscore the growing importance of Healthtech in addressing complex medical challenges.

Web3 and Cryptocurrency: Signs of Recovery

The Web3 industry, encompassing blockchain technologies, cryptocurrencies, and NFTs, has faced substantial challenges over the past two years. Funding for Web3 startups fell by 74% year-over-year in 2023, but Q1 2024 brought a glimmer of hope with the first quarterly increase in venture funding since Q4 2021. Bitcoin’s resurgence, reaching an all-time high above $70,000 in early 2024, and regulatory acceptance of Bitcoin ETFs have revived interest in the sector. However, the industry remains cautious, focusing on developing practical applications and moving away from speculative ventures.

Metaverse and VR: A Reality Check

The Metaverse and Virtual Reality (VR) sector, once hailed as the next frontier of digital innovation, has struggled to deliver on its promises. Funding hit an all-time low in 2023, reflecting the industry’s inability to achieve mass adoption. Despite this, companies like Apple continue to push the boundaries with innovations such as the Vision Pro headset, which aims to address the challenges of isolation and discomfort associated with VR technologies.

Industry Distribution and Unicorns

The Software & Data sector remains the largest industry for startups, accounting for 33.7% of global startups. Ecommerce & Retail have also seen significant growth, increasing their share from 9.5% to 11.4%. Healthtech, on the other hand, has seen a decline from 12.8% to 9.5%, indicating a shift towards consolidation and innovation by larger corporations. When it comes to unicorns, Software & Data lead the pack, representing 39.2% of all unicorns. Fintech follows with 20.8%, and Ecommerce & Retail with 11.5%. Notably, the Transportation industry, although smaller in size, has demonstrated high scalability, with 6.5% of the world’s unicorns operating in this sector.

Economic Environment and Investor Sentiment

Global startup funding saw a significant downturn, with a notable drop from the peak in 2021. The total investment fell from $190.5 billion in Q4 2021 to $66.1 billion in Q1 2024. The value of large exits decreased by 86% in 2022 compared to 2021 and further declined by 47% in 2023. This trend impacts ecosystem growth, as capital and talent remain locked in longer than desired. Startups securing Series A deals are older, with the median age increasing from 3.4 years in 2019 to 4.2 years in 2023, indicating a shift towards longer runway periods before raising Series A rounds.

Sector-Specific Trends and Geographic Shifts

Generative AI startups have received substantial attention, with 18% of all VC funding going to GenAI-focused startups in 2023. Cleantech startups showed resilience amid funding challenges, with late-stage Cleantech funding increasing significantly. Europe leads early-stage Cleantech funding, driven by EU policies and initiatives. Emerging ecosystems are capturing a larger share of Series A funding, with the share for the Top 100 Emerging Ecosystems reaching 19% in 2023, up from 13% in 2019. North America remains the leading region with 18 of the Top 40 tech startup ecosystems, while Europe shows strong performance in specific sectors like Cleantech.

Unicorn Trends and Investor Sentiment

The number of new unicorns continued to decline in 2023, with a 58% drop compared to 2022. However, there was a slight recovery in Q1 2024, with 25 new unicorns, the most since Q4 2022. Over half of the new unicorns in 2023 were in the GenAI and Deep Tech sub-sectors, indicating strong investor interest in these areas. Despite the challenging environment, there are signs of improving conditions. Series A funding amounts are on track to increase by 18% from Q4 2023 to Q1 2024. Additionally, a survey by the Kauffman Foundation in April 2024 found that 53% of firms plan to increase their investments in 2024.

These insights are derived from the Global Startup Ecosystem Index 2024 and the Global Startup Ecosystem Report 2024, highlighting the dynamic nature of the global startup ecosystem with shifting investment patterns, sector-specific growth, and emerging regional players redefining the landscape.

Portugal’s Position in the Global Startup Ecosystem

National Overview

Portugal’s startup ecosystem has faced significant challenges over the past year. In the Global Startup Ecosystem Index 2024, Portugal ranks 29th globally, a decline of three spots from the previous year. This drop marks one of the steepest declines among the top 30 countries, highlighting the need for strategic improvements to regain its competitive edge.

Lisbon: A Mixed Performance

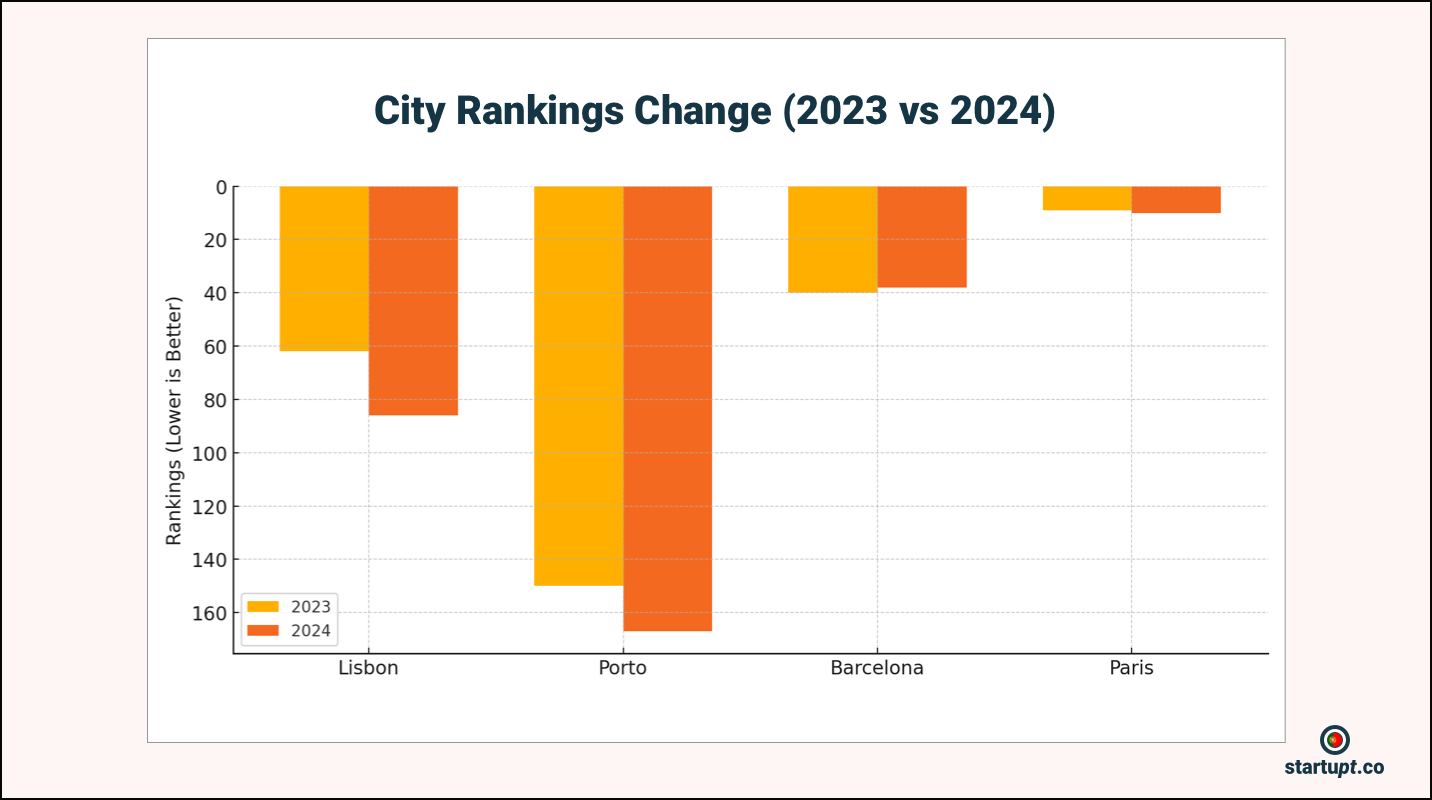

Lisbon’s startup ecosystem presents a mixed picture. In Startup Genome report, Lisbon ranks in the 31-40 range among emerging ecosystems, showcasing its growing tech community, robust infrastructure, and supportive governmental policies. Lisbon’s performance across various criteria such as funding, talent, market reach, and knowledge is noteworthy, positioning it as a critical hub for innovation and entrepreneurship in Europe.

However, Global Startup Ecosystem Index 2024 indicates a dramatic decline in Lisbon’s global ranking, placing it at 86th, a drop of 24 spots, marking its lowest position since 2020. Within Europe, Lisbon is now ranked 24th and 16th within the EU, highlighting its struggles in maintaining its status as a leading startup hub. This contrast underscores the need for a concerted effort to bolster the city’s startup environment.

Porto: Challenges and Opportunities

Porto’s startup ecosystem is experiencing both challenges and opportunities. In Startup Genome report, Porto is ranked in the 71-80 range among emerging ecosystems, indicating potential growth (it’s the first time for Porto to be in this top 100). The city’s tech scene is expanding, supported by local government initiatives and an increasing number of accelerators and incubators. Porto’s improving funding environment and developing market reach offer promise for the future.

Conversely, another report paints a less optimistic picture, showing Porto falling out of the global top 150 to rank 167th. The city has lost its position within the top 100 for Fintech, a sector where it previously showed promise. This decline underscores the need for enhanced support and innovation in key sectors to revive Porto’s startup ecosystem.

But there are some positive signs. Porto’s startups reached more than €6.4b in ecosystem value, between July 1, 2021 and December 31, 2023, according to the Startup Genome report. And Porto’s technological ecosystem annual growth in 2023 — 53% in the value compared to the same period in 2021. Also also the report placed the city among the 35 best European ecosystems in terms of accessible talent.

Braga and Leiria: Emerging Hubs

While Lisbon and Porto face challenges, Braga and Leiria show potential as emerging startup hubs. Braga ranks 495th globally, while Leiria has shown the greatest progress, climbing 33 positions globally. These cities represent the next wave of startup activity in Portugal, offering new opportunities for growth and development.

Comparison with Spain and France

Spain: A Strong Competitor

Spain’s startup ecosystem remains robust, ranking 15th globally and retaining its position as the leading ecosystem in Southern Europe. Barcelona, Spain’s top startup city, ranks 38th globally, maintaining its status as the region’s leading startup hub. This strong performance highlights the competitive challenges that Portuguese cities face in the European landscape.

France: A Model of Stability and Growth

France continues to demonstrate stability and growth in its startup ecosystem. Ranking 8th globally, France is Europe’s fourth most successful startup nation. Paris, the country’s top startup city, ranks 10th globally, highlighting its strong position in the global startup hierarchy. France’s robust ecosystem sets a high benchmark for Portugal and other European countries.

Industry Focus in Portugal

Artificial Intelligence

Portugal has a growing presence in the AI sector, with startups leveraging advancements in AI technologies to drive innovation. The country’s high-quality engineering talent and favorable business environment make it an attractive destination for AI startups.

Healthtech

The Healthtech sector in Portugal is experiencing growth, driven by innovations in medical technologies and digital health solutions. Startups in this sector are capitalizing on global trends and investments to develop cutting-edge healthcare solutions.

Ecommerce & Retail

Ecommerce & Retail is another sector showing promise in Portugal. The growth in consumer adoption of online shopping and advancements in retail technologies align with global trends, offering new opportunities for Portuguese startups.

Strategic Recommendations for Portugal

To regain its competitive edge, Portugal must focus on several strategic areas:

- Enhanced Government Support: Increased government support through funding, incentives, and policy initiatives is crucial to revitalizing the startup ecosystem.

- Fostering Innovation: Encouraging innovation in key sectors such as AI, Healthtech, and Ecommerce & Retail will help drive growth and attract investment.

- Strengthening Ecosystems: Developing strong local ecosystems in cities like Lisbon and Porto, while supporting emerging hubs like Braga and Leiria, is essential for balanced national growth.

- Global Collaboration: Building international partnerships and collaborations can help Portuguese startups access new markets and resources.

Reflecting on 2023: Portugal’s Journey

Performance in 2023

In the Global Startup Ecosystem Index 2023, Portugal ranked 26th globally, demonstrating a stronger position compared to 2024. Lisbon was ranked 62nd globally, and Porto was within the top 150. The decline in rankings over the past year highlights the challenges that Portugal’s startup ecosystem has faced.

Key Changes and Challenges

Several factors have contributed to the decline in Portugal’s rankings:

- Economic Uncertainty: The global economic downturn and declining startup funding have impacted Portugal’s startup ecosystem.

- Competitiveness: Increased competition from other European countries, particularly Spain and France, has challenged Portugal’s position.

- Policy and Support: The need for enhanced government support and strategic policies to foster innovation and growth.

Moving Forward

To address these challenges and improve its position in future rankings, Portugal must focus on creating a supportive environment for startups, fostering innovation, and building strong ecosystems across the country. By addressing these key areas, Portugal can regain its competitive edge and continue to thrive in the global startup landscape.

—

Portugal’s startup ecosystem, with Lisbon and Porto as key players, is on an upward trajectory despite recent challenges. The progress in the past year is commendable, and the country’s proactive approach to fostering innovation and entrepreneurship is yielding results. With continued focus on enhancing funding opportunities and expanding market reach, Portugal is well-positioned to climb higher in global rankings and become a significant player in the European startup scene.

Comparing the current state with the previous year’s Global Startup Ecosystem Index, Portugal shows improvement in rankings and ecosystem development. This positive trend reflects the concerted efforts of the government, private sector, and the vibrant startup community in Portugal.