Two comprehensive reports have shed light on the evolving artificial intelligence (AI) landscape in Europe and Portugal’s digital transformation journey. The “AI Europe report 2024” by Dealroom and Roosh, and AWS and Strand Partners’ “Unlocking Europe AI Potential” offer valuable insights into the current state and future potential of AI across the continent.

Key Takeaways:

AI Funding Surge:

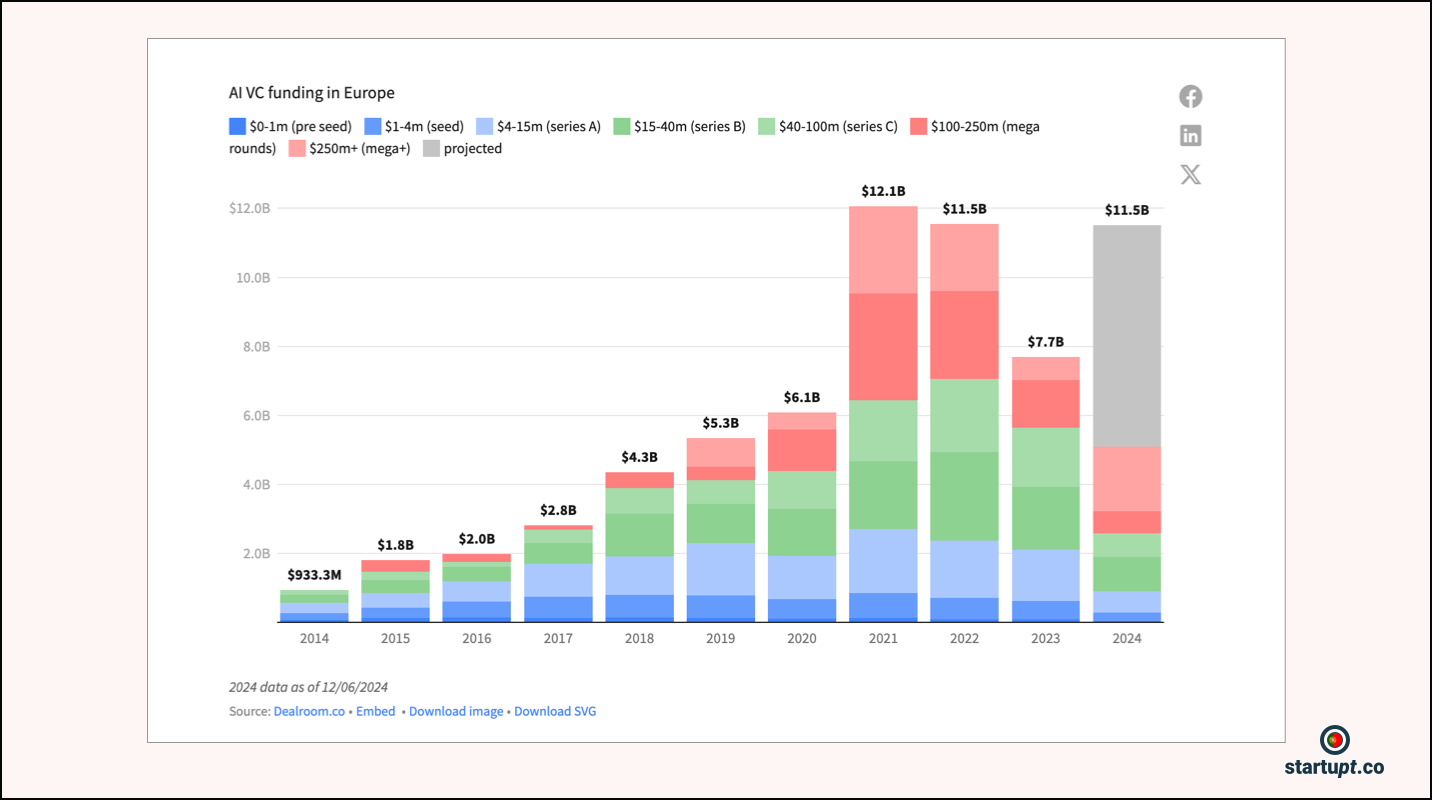

- AI now accounts for a record 18% of venture capital funding in Europe, up from just over 4% in 2012.

- AI funding in Europe has grown more than 10x in the last decade.

- In 2024, AI funding is on track to surpass last year by nearly 50% and match 2022 levels.

- The UK, France, and Germany are dominating AI investing, attracting 77% of all AI funding in Europe in 2023-2024, compared to 59% for the rest of tech.

- The UK leads with $2.1B in AI funding in 2024, followed by France with $1.2B.

Generative AI Boom:

- Funding for generative AI in Europe in 2024 has already surpassed $2.8B, exceeding any previous year’s total in less than six months.

- Most Generative AI funding is going to model makers and applications with proprietary models.

- The median round size for Generative AI startups is significantly higher than for conventional AI and non-AI sectors across all stages (Seed, Series A, Series B).

Talent Concentration:

- Europe has a per-capita concentration of AI experts among software engineers 30% higher than the US and almost three times as high as China.

- London has nearly four times more AI engineers than any other European city, followed by Paris, Berlin, Zurich, and Madrid.

- Dublin has the highest density of AI engineers, followed by Zurich.

Sector Breakdown:

- The vast majority of AI funding is going to applications, mainly in autonomous driving, health, and enterprise software.

- In 2024, autonomous driving, GenAI foundational models, and AI x enterprise software are the leading segments.

- AI is increasingly being adopted in gaming, with 87% of game studios already using AI in some form.

Global Comparison:

- The US invested nearly 7x more in GenAI than Europe since 2022, and 3x more in the rest of AI.

- Europe is strong in AI x Fintech, Drug Discovery, Security, and Robotics, but lags behind in GenAI foundational models and AI chips and processors.

- China and the US dwarf Europe’s number of AI patents, with AI patent grants worldwide increasing by 62.7% from 2021 to 2022.

Investment Trends:

- Non-European investors account for over 80% of $250M+ rounds in AI, up from less than 25% at early stage, mostly coming from US investors.

- US investors participated in 490+ rounds in European AI startups in 2023-2024.

- Over 70% of rounds of $40M+ had at least one US investor participating.

What about Portugal:

- Portugal’s Digital Acceleration: Portuguese businesses increased their digital technology investments by 61% in the past year, outpacing the European average of 51%. AI adoption in Portugal grew from 28% in 2022 to 35% in 2023, representing a 25% year-on-year increase.

- Economic Potential: The accelerated adoption of digital technologies, particularly AI, could unlock €61 billion for the Portuguese economy.

Trends:

- AI Permeation: AI is increasingly penetrating various sectors, from autonomous driving and healthcare to enterprise software and cybersecurity.

- Focus on Privacy: There’s growing emphasis on privacy-enhancing technologies like fully homomorphic encryption and synthetic data generation to address data privacy concerns in AI development.

- Gaming and AI Convergence: The gaming industry is rapidly adopting AI for in-game intelligence, game development, and player assistance, with the market projected to grow from $992 million in 2022 to $7.1 billion by 2032.

- Regulatory Landscape: The EU AI Act and UK’s sector-specific approach highlight different regulatory strategies, impacting AI development and adoption across Europe.

Portugal’s AI Landscape:

Portugal is making significant strides in digital transformation and AI adoption according “Unlocking Europe AI Potential” report. The country’s businesses are increasingly relying on digital technologies, with 81% reporting they would struggle to function without them. AI adoption among Portuguese businesses (35%) is higher than the European average (28%), with 64% of AI-adopting businesses using generative AI and large language models.

However, challenges remain. The digital skills gap is a significant barrier, with 71% of businesses reporting difficulties in hiring staff with good digital skills. To address this, 87% of businesses are investing in digital training for employees, and 84% require a minimum digital skill level for new recruits.

Portuguese citizens are generally optimistic about AI’s potential, with 60% believing it can help address global issues like climate change. However, 82% express some concerns about AI development, primarily related to potential job losses.

Conclusion:

Based on the reports’ findings, we spotted the following five niches present promising opportunities for startups in Portugal:

- AI-driven Healthcare Solutions: With 72% of citizens envisioning AI transforming healthcare, startups focusing on AI applications in medical research, diagnostics, and personalized treatment plans could attract significant interest.

- EdTech with AI Integration: As 63% of citizens see AI transforming education, startups developing AI-powered learning platforms or adaptive educational tools could find a receptive market.

- AI for Sustainable Transportation: With 64% of citizens expecting AI to transform transportation, startups working on smart mobility solutions or AI-optimized logistics could thrive.

- Enterprise AI Solutions: Given the high adoption rate of AI among Portuguese businesses, startups offering AI-powered tools for business process optimization, customer experience enhancement, or data analytics could find numerous opportunities.

- Privacy-Enhancing AI Technologies: As data privacy concerns grow, startups developing solutions in areas like homomorphic encryption, federated learning, or synthetic data generation could address a critical need in the market.

These niches align with both global AI trends and Portugal’s specific digital ambitions, potentially offering attractive investment opportunities in the country’s evolving AI ecosystem.