The European venture capital (VC) landscape is experiencing a remarkable renaissance in 2024, characterized by substantial growth across various sectors and stages of investment. As the continent rebounds from the economic impacts of recent years, it is clear that the tech ecosystem is not only recovering but also thriving, driven by significant funding rounds in energy, fintech, and artificial intelligence (AI).

This review delves into the key numbers and trends shaping Europe’s VC scene, drawing insights from the Dealroom’s Europe Tech and VC Q2 2024 Report. We will explore historical investment trends, with a particular focus on Portugal’s burgeoning investment landscape, compare Portugal’s performance with its Southern European counterparts, Spain and France, and draw conclusions about the broader European tech ecosystem.

Europe Overview: Key Numbers and Trends

The European tech scene has experienced a remarkable resurgence in 2024, with significant growth across multiple sectors. Key data and trends highlight the vibrancy of the ecosystem.

Venture Capital Investments: European startups raised $15.6 billion in Q2 2024, marking a 14% increase from Q1 and a 12% year-on-year growth . The first half of 2024 saw a total of nearly $30 billion in tech investments, driven by large funding rounds in the Energy and Fintech sectors.

Investment Breakdown: The surge in late-stage investments (Series B and C) has been notable, with over $5 billion invested in late-stage funding rounds, marking an 8% year-on-year increase . Early-stage funding has remained stable, indicating a balanced investment approach across different startup stages.

Sector Focus: Energy has emerged as the most funded sector in Europe so far in 2024, continuing its dominance from 2023. Hydrogen companies, in particular, have attracted significant investments, such as HysetCo’s €200 million round in Paris. Fintech follows closely, with $5.4 billion raised by 230 companies, including major rounds by Monzo and Abound.

Country Highlights:

- United Kingdom: Leading the European VC landscape, the UK raised $9.4 billion in 2024, with London alone accounting for $6.8 billion, a 30% increase from 2023. Cambridge also featured prominently with $664.6 million raised.

- Germany: Germany secured $12 billion in VC investments, with significant contributions from its tech hubs like Berlin and Munich.

- France: France raised $4.3 billion, with Paris contributing $3.1 billion. The country has seen substantial investments in AI and energy sectors, cementing its position as a key player in European tech.

- Netherlands: The fastest-growing country in 2024, driven by large funding rounds for companies like Picnic, Mews, and Moove. The Netherlands has positioned itself as a burgeoning tech hub.

Top Cities: VC investments are concentrated in Northern cities, with London, Berlin, and Paris leading the way. Other notable cities include Amsterdam, Munich, and Stockholm, reflecting the diverse tech landscape across Europe.

Investment Stages: Early-stage European VC has been relatively stable, while late-stage investment is up year-on-year in Q2 2024 and ahead of Q1. Breakout-stage VC is at its highest in six quarters, highlighting investor confidence in scaling promising startups.

Portugal’s Investment Landscape

Portugal’s venture capital landscape in 2024 reflects significant growth and increasing investor interest.

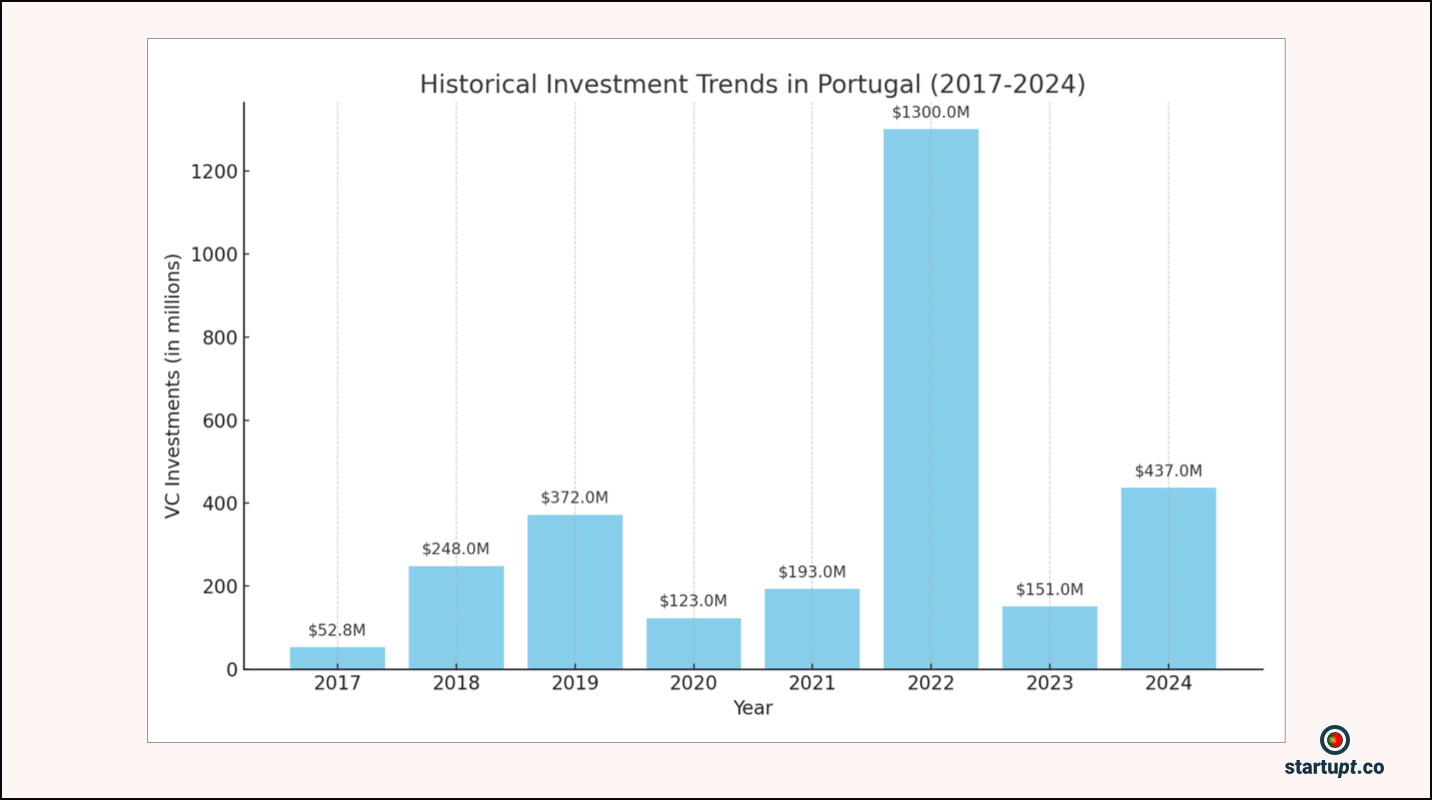

Historical Investment Trends: Portugal has shown a steady increase in VC investments over the past few years:

- 2017: $52.8 million

- 2018: $248 million

- 2019: $372 million

- 2020: $123 million

- 2021: $193 million

- 2022: $1.3 billion

- 2023: $151 million

- 2024: Projected to reach $437 million.

Sector Focus: The tech and energy sectors dominate Portugal’s investment landscape. The country has made significant strides in renewable energy technologies, aligning with broader European trends towards sustainability and clean energy.

Key Investments: Notable funding rounds in Portugal include significant investments in renewable energy projects and tech startups. These investments have helped Portugal build a reputation as a burgeoning tech hub in Southern Europe.

Investment Drivers: Factors contributing to the growth of VC investments in Portugal include government incentives, a growing tech-savvy workforce, and an increasing number of successful startup exits that have attracted further investor interest.

What About Spain and France

Comparing Portugal with Spain and France reveals several key differences and similarities:

France:

- Investment Volume: France remains one of the top three countries in Europe for VC investments, with $4.3 billion raised in 2024. Paris alone contributed $3.1 billion, highlighting the city’s central role in the French tech ecosystem.

- Sector Strengths: France has a strong focus on AI and energy sectors. Major investments in AI, such as those in companies like Wayve and Mistral AI, have positioned France as a leader in tech innovation.

- Growth Drivers: France benefits from a supportive government policy for tech innovation, a robust research and development infrastructure, and a large pool of tech talent, which have all contributed to its strong performance in attracting VC investments.

Spain:

- Investment Volume: Spain’s investment profile is strong but not as dominant as France. In 2023, Spain raised $6.3 billion, with projections for 2024 suggesting continued growth to $8.4 billion.

- Sector Diversification: Spain’s investments are spread across various sectors, including fintech, health tech, and renewable energy. This diversification has helped mitigate risks and attract a broad range of investors.

- Key Cities: Madrid and Barcelona are the primary hubs for VC investments in Spain, with both cities attracting significant funding rounds for various startups.

Portugal:

- Investment Volume: While Portugal’s absolute investment figures are lower compared to Spain and France, the growth rate is notable. From $52.8 million in 2017 to a projected $437 million in 2024, Portugal’s tech ecosystem is rapidly expanding.

- Sector Strengths: Portugal’s focus on renewable energy and tech startups aligns with broader European trends. Investments in these sectors have been crucial in driving the country’s growth.

- Strategic Positioning: Portugal is positioning itself as an attractive destination for investors looking for emerging opportunities in Southern Europe. Government incentives, a skilled workforce, and successful startup exits are driving this growth.

Conclusions

The European tech and venture capital landscape in 2024 is characterized by robust growth and dynamic investments across various sectors and stages. Key highlights include:

- Investment Growth: Europe has seen a significant increase in VC investments, particularly in the Energy and Fintech sectors, which are driving much of the continent’s growth.

- Top Performers: The UK, Germany, and France continue to dominate the VC landscape, with notable growth in the Netherlands and increasing activity in Portugal.

- Sectoral Trends: Energy and AI are the leading sectors, reflecting a broader trend towards sustainability and technological innovation.

- Emerging Hubs: While traditional hubs like London, Paris, and Berlin lead in investment volumes, emerging hubs such as Lisbon and Amsterdam are gaining traction.

Overall, the European tech ecosystem is poised for continued expansion, with a strong emphasis on innovative and sustainable technologies. Portugal, with its growing investment landscape, is well-positioned to become a key player in the Southern European tech scene.