The European venture capital landscape endured significant challenges in 2023, with investment volumes nearly halved compared to the previous year. Portugal was no exception, witnessing a steep decline in VC activity as funds across the continent faced growing headwinds.

2023 was a difficult year for venture capital (VC) across Europe, with many countries recording sharp declines in funding levels compared to 2022. According to the Q4 2023 Global Fund Performance Report by PitchBook, venture capital globally saw only a modest quarterly return of 0.8%, while European funds struggled to break out of negative territory. The picture in Europe is stark, with investment deal values falling nearly 50% year-over-year, a troubling sign for the region’s startup ecosystem.

European Decline, Portuguese Struggles

Startups in Europe and Israel raised a total of €53.4 billion (around $58.7 billion) in 2023, down a striking 48.9% from 2022 levels, based on data from PitchBook. Countries like Portugal, Italy, and Greece were among the hardest hit. Portuguese startups and funds, in particular, found themselves grappling with persistent downturns. By the close of the year, the Portuguese venture ecosystem saw investments dwindle as local investors pulled back amid broader macroeconomic concerns.

Notably, Portugal, which had begun to develop a promising startup scene in the past few years, saw its growth momentum stall. There were fewer significant rounds compared to prior years, with both domestic and international VCs becoming increasingly cautious.

This decline is part of a broader trend across Southern Europe. Spain also saw its total VC deal value halved in 2023, with only €1.7 billion raised. The collective struggles of Southern European nations reflect the region’s vulnerability to global macroeconomic challenges, further exacerbated by rising interest rates and an uncertain geopolitical environment.

Global Performance Reflects Broader Trends

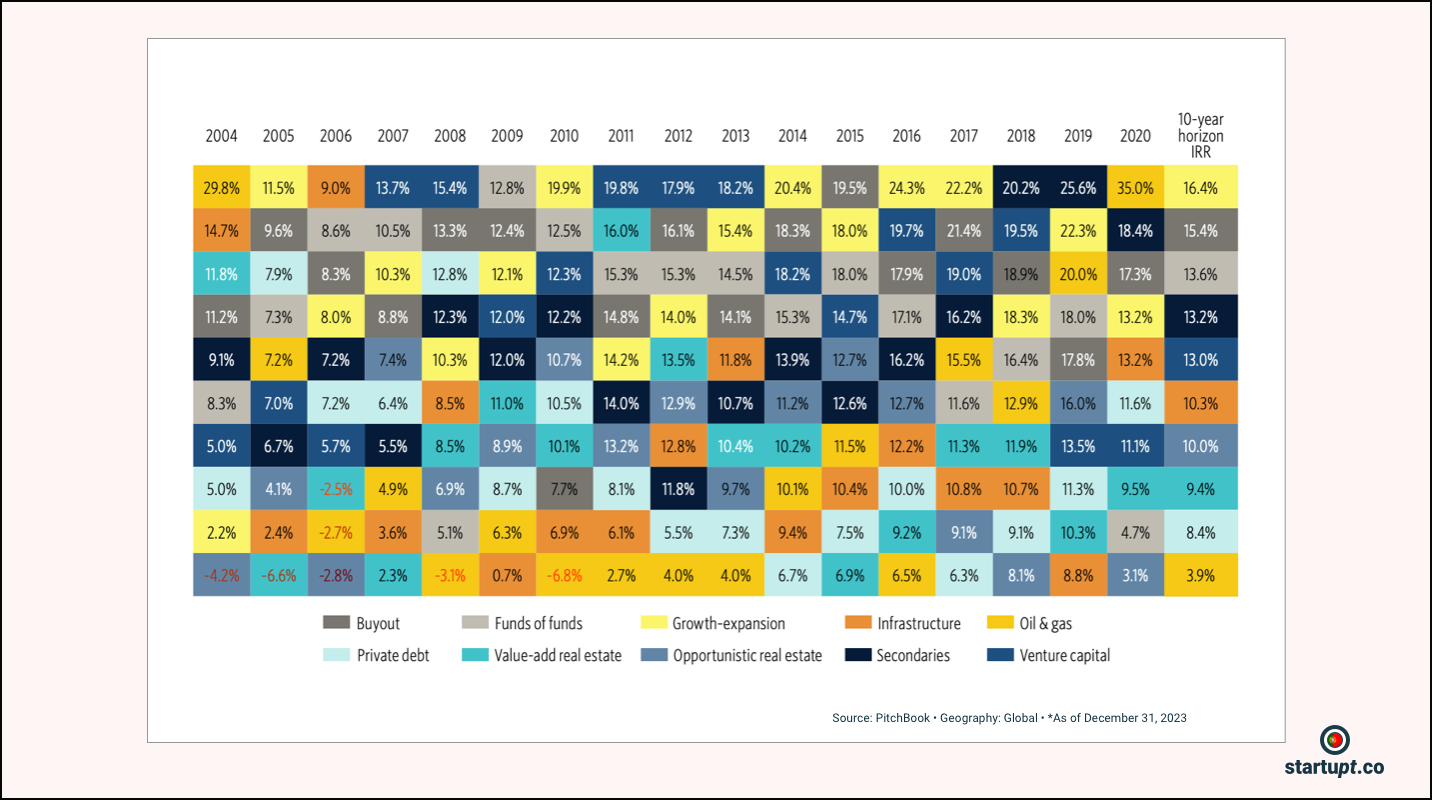

The downturn in Europe mirrored broader global trends, as VC funds worldwide faced difficulties. The Q4 2023 Global Fund Performance Report highlights that venture capital delivered negative returns in 2023, with a one-year IRR of -3.0%. This follows six consecutive quarters of negative returns globally for VC funds, signaling a stagnation in deal activity and exits.

Although some optimism surfaced in Q4 2023—where VC funds recorded a small uptick of 0.8% in quarterly performance—the overall picture remains one of cautious pessimism. Globally, venture capital struggled to achieve meaningful returns, a stark contrast to the high valuations and abundant capital that defined the space during 2020 and 2021.

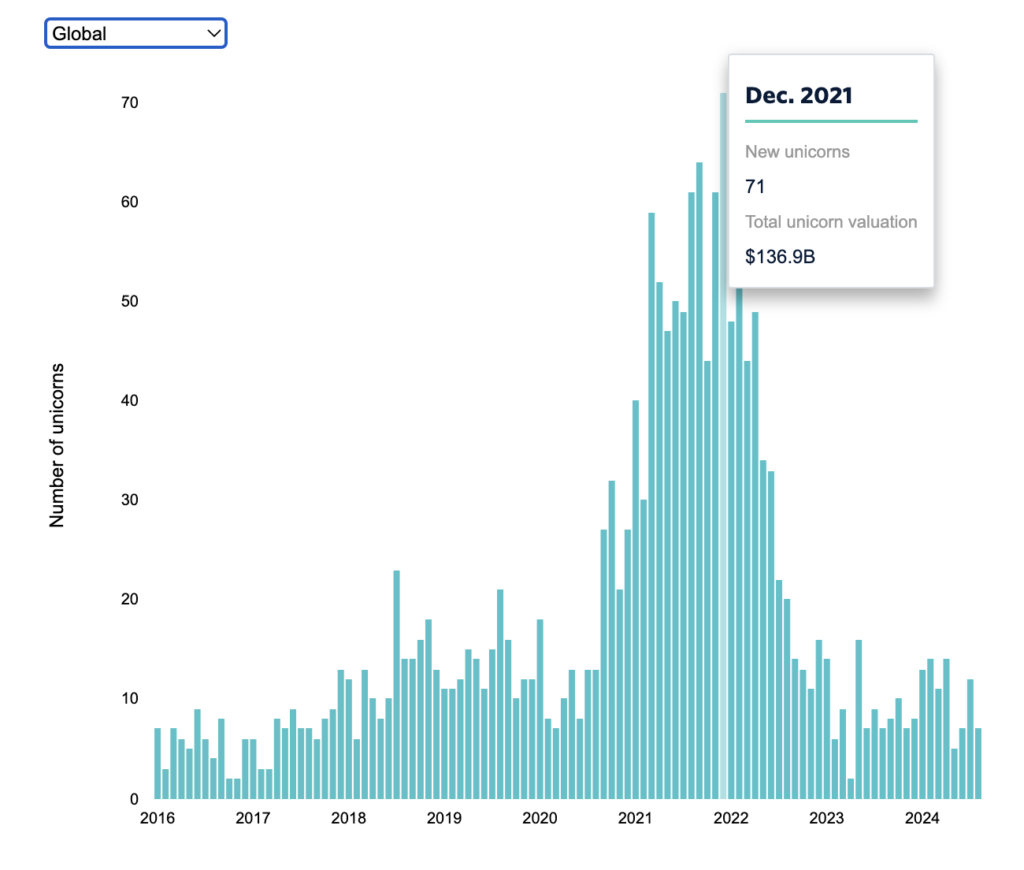

And by the way, have a look at the number of unicorns through the last several years.

The Road Ahead for Portuguese and European Startups

The outlook for 2024 remains uncertain, particularly for regions like Portugal that depend heavily on international capital flows. As global VC investors continue to reassess their portfolios and strategies, Portuguese startups may need to adjust their expectations and timelines.

One potential silver lining lies in the recent stabilization of valuations, which could entice investors to re-engage with the market at lower entry points. However, until exit markets open up, and macroeconomic conditions improve, the road ahead looks challenging for both Portuguese funds and the broader European venture capital ecosystem.

For Portugal, the key will be to regain investor confidence and navigate the increasingly complex global funding landscape. Whether 2024 will see a recovery in European venture capital or further stagnation remains to be seen. Nonetheless, the future of Portugal’s burgeoning tech sector, which had begun to show significant promise, hangs in the balance as the broader market struggles to regain momentum.

The combination of declining global performance and local challenges paints a sobering picture for 2023, with Portugal’s startup scene left searching for answers amid a turbulent venture capital environment.