Sifted’s latest B2B SaaS Rising 100 report offers a panoramic view of Europe’s most promising software startups, showcasing the resilience and innovation of the continent’s tech ecosystem amid challenging market conditions. This comprehensive analysis not only highlights the companies to watch but also provides crucial insights into the trends shaping the future of European tech.

Key Findings:

- AI Dominance The rise of artificial intelligence is the standout story of this year’s report. Generative AI startup V7 claims the top spot, with a total of seven GenAI companies making the cut. Four of the top 10 – V7, Poolside AI, Qdrant, and Adaptive ML – are focused on AI technologies, underscoring the transformative potential of this field.

V7, based in London, exemplifies the rapid growth in this sector. Their recent launch of V7 Go, an AI tool designed to learn and automate work processes, garnered an impressive 4,000 signups and £3m in pipeline within just one month. This success story highlights the increasing appetite for AI solutions across industries.

- Geographic Distribution The report reaffirms London’s position as Europe’s tech capital, with the city hosting 31 of the top 100 startups. Tel Aviv follows with 12, and Berlin with 11. This concentration of activity in a few key hubs raises important questions about tech development and investment distribution across Europe.

Notably, the report points to Munich as an emerging deeptech hub, hosting five companies on the list including TWAICE, Orbem, Tacto, DataGuard, and advastore. This development suggests a potential diversification of Europe’s tech landscape beyond the traditional powerhouses.

- Sector Breakdown Enterprise software continues to lead the pack with 45 companies, followed by fintech (30), deeptech (11), and healthtech (8). A significant development is the strong showing of climate tech, with 6 startups making the list. This reflects the growing demand for carbon capture and accounting solutions, as businesses increasingly prioritize sustainability and environmental responsibility.

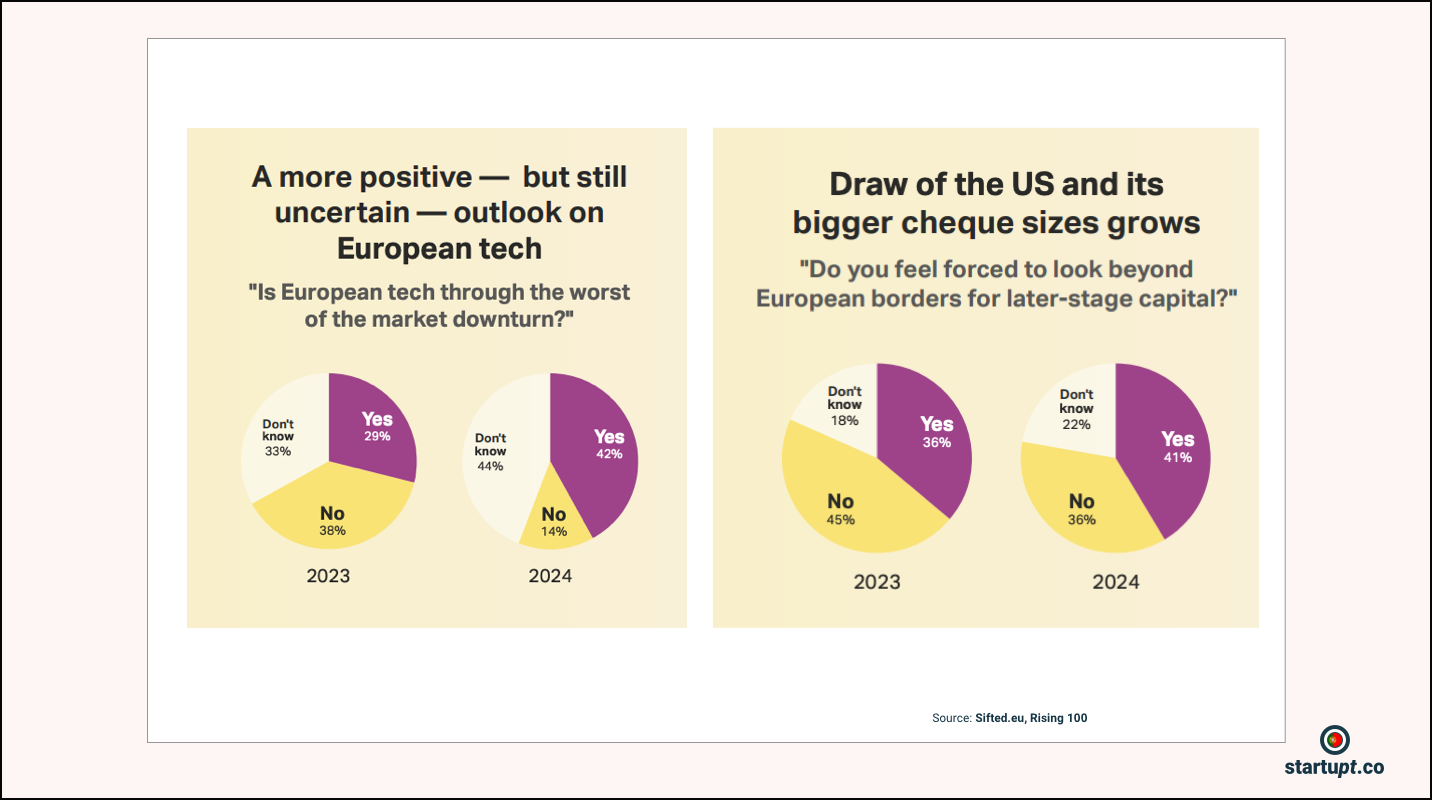

- Funding Trends In a notable shift, the 2024 cohort has raised 24% less capital than the 2022 group. This trend towards capital efficiency is further emphasized by the increased representation of early-stage startups, with seed and Series A companies making up 47% of the list, up from 26% in 2023.

This shift suggests a changing investment landscape, where startups are expected to achieve more with less funding. It also indicates a potential return to fundamentals, with investors focusing on sustainable business models rather than growth at all costs.

- Investor Landscape Balderton Capital and Speedinvest emerge as the most active private investors, each backing 12 companies on the list. The report notes a trend towards more crowded cap tables at earlier stages, suggesting VCs are hedging bets with smaller ticket sizes in response to market uncertainties.

Emerging Trends and Notable Companies:

Climate Tech on the Rise: Startups like Sylvera, Plan A, and Sweep are gaining significant traction with their tools for carbon accounting and emissions disclosure. These companies are addressing the growing need for supply-chain carbon accounting (Scope 3 emissions), reflecting increased regulatory pressure and corporate commitment to sustainability goals.

Fintech Resurgence: After a challenging period, the fintech sector shows signs of recovery. Stockholm-based Brite Payments exemplifies this trend, having raised the largest Series A round for a European fintech in 2023 at $60m. The company’s success in account-to-account payments highlights the ongoing innovation in financial technologies.

Healthtech Innovation: Companies like Lindus Health are working to overhaul outdated processes in medical research. Their “anti-CRO” approach to clinical trials is gaining traction among pharmaceutical companies, demonstrating the potential for tech disruption in traditionally conservative industries.

Challenges and Opportunities:

The report also sheds light on ongoing challenges in the European tech ecosystem. The lack of diversity in tech leadership remains a concern, with only 17% of the top 100 companies having female co-founders. This statistic underscores the need for continued efforts to promote inclusivity and diversity in the tech sector.

Additionally, the concentration of startups in a few key hubs highlights the need for more distributed tech development across Europe. While cities like Munich are emerging as new centers of innovation, there’s still work to be done to foster tech ecosystems in other regions.

Portuguese SaaS Startup Ecosystem

While the Sifted Rising 100 report provides a comprehensive overview of Europe’s most promising B2B SaaS startups, it’s worth noting some connections to the Portugal startup ecosystem and to have a brief look on how does it compile with pan-European trends.

- Diverse sectors: Much like the Rising 100, Portuguese startups cover a wide range of industries. Standouts include Infraspeak (facilities management), Codacy (software testing), Nutrium (nutrition tech), and Sensei Tech (retail automation).

- AI and machine learning focus: Mirroring the broader European trend highlighted in the Sifted report, many Portuguese startups are leveraging AI. Examples include EdgenAI (decentralized GenAI solutions), Automaise (AI for productivity), and BRAINR (AI-enabled cloud manufacturing).

- Climate tech and sustainability: The Rising 100 noted increased representation of climate tech startups. Portugal also shows this trend with companies like Treescape (agroforestry design) and Trash4Goods (recycling rewards platform).

- Health and wellness: Health tech was a growing category in the Sifted report, and Portugal’s list includes several relevant startups like knok Healthcare (telemedicine), NU-RISE (radiotherapy improvements), and OneCare (elderly care tech).

- Fintech presence: While not as dominant as in the Rising 100, fintech is represented by startups like idntty (digital identity management) and Wazza (mobile payments analytics).

- International expansion: Some startups, like EmbedSocial and Nimbld Ventures, show a focus on international markets, aligning with the global ambitions of companies in the Rising 100.

While Portuguese startups may not yet feature prominently in pan-European rankings like the Sifted Rising 100, this diverse ecosystem demonstrates the country’s potential as an emerging tech hub. The focus on AI, sustainability, and health tech aligns with broader European trends, suggesting that Portuguese startups are well-positioned to grow and potentially break into future editions of such rankings.

As the European tech landscape continues to evolve, Portugal’s SaaS sector represents an area to watch, offering opportunities for investors looking to diversify beyond the established tech centers highlighted in the Sifted report.