The newsletter about startups in Portugal

7 questions for 1 startup: Jupiter App

Today is April 29, 2024. You're reading '7/1', Monday edition of Startupt

Hello! This is Sergei, founder and editor of Startupt.co. Today we are going to talk about taxes. In the growing gig economy, tax management is complex and requires dealing with multiple systems. The launch of Jupiter App promises a simpler tax process for freelancers and small businesses.

Addressing a market gap, Jupiter App targets freelancers and smaller firms who've lacked comprehensive tools. It's a strategic response to the rise in freelance and remote work, offering a user-friendly, integrated service.

Jupiter App speeds up and cuts the cost of tax tasks by automating calculations and form filling, and integrating with tax systems, streamlining the tax process end-to-end.

Not just efficient, Jupiter App is also going to have cost-effective solution, charging less than traditional accounting. Focusing on Europe's freelancer-rich areas, it's set to tap into a promising market.

This edition looks at Jupiter App’s potential to transform tax automation, considering legal, market, and technological shifts. Jupiter App is expected to redefine efficiency and user experience in tax services.

📊 Market size. Quick look

The tax automation software market is thriving due to the need for businesses to navigate complex tax rules and streamline tax tasks. This growth is fueled by advanced, user-friendly technologies that meld with financial systems.

Key functions of this software include tax computation and regulatory compliance, essential for reducing errors and boosting efficiency. A competitive field, the market offers diverse solutions to meet different business needs.

Market insights reveal:

— Expected steady market growth.

— Rising regulatory complexities drive the need for accurate tax reporting.

— The popularity of cloud solutions is climbing for their scalability.

— Both large and smaller businesses are adopting tax automation.

— North America and Europe dominate the market; Asia Pacific and Latin America are catching up, driven by tax compliance needs and digital finance.

The market's competitiveness is marked by key players providing varied tax automation solutions.

Market growth is driven by:

— Complex tax regulations.

— The necessity of error-free tax reporting.

— The quest for operational efficiency.

— The uptake of cloud solutions for flexible, anywhere tax management.

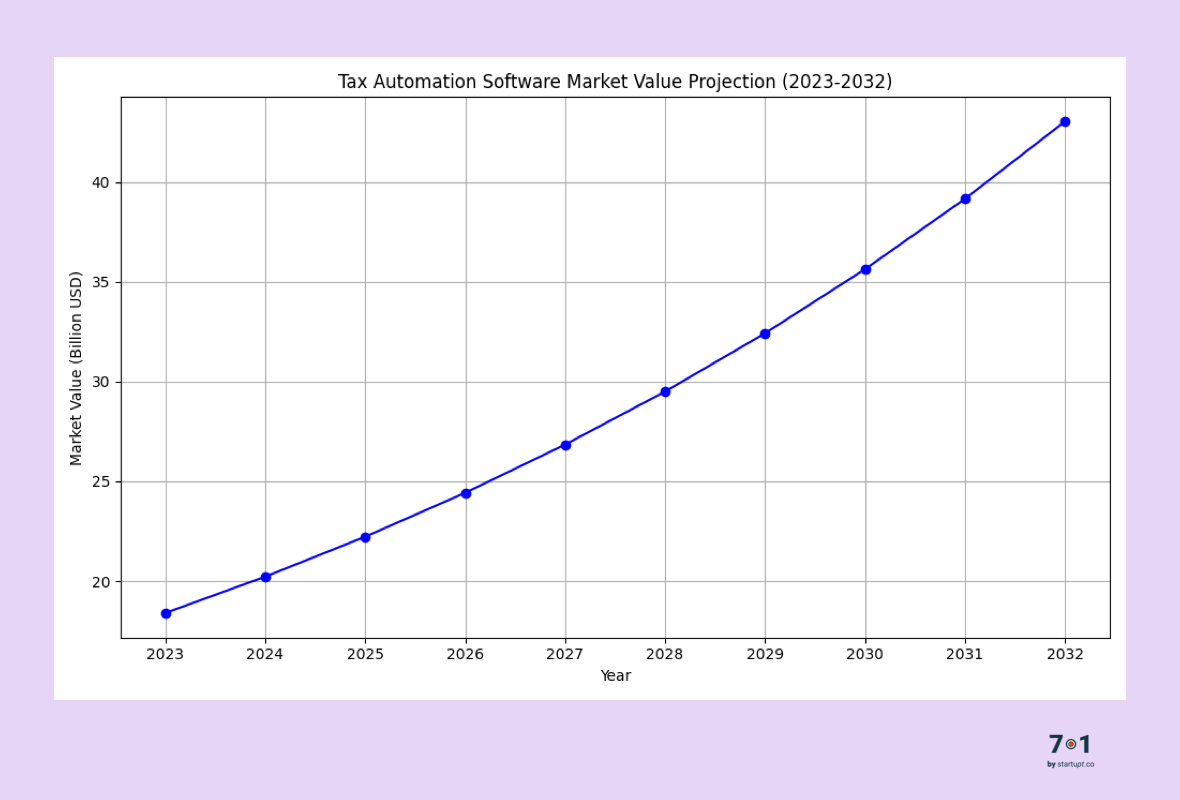

The market, valued at $18.4 Billion in 2023, is projected by IMARC Group to hit $44.0 Billion by 2032, growing at a 9.9% CAGR between 2024-2032, emphasizing tax automation's critical role in the global business milieu.

💡 Jupiter App's Pitch deck summary

Name: Jupiter App.

Location: Lisbon.

Industry: Fintech, taxtech.

Problem Addressed: Jupiter App seeks to streamline the tax preparation and payment process, which is often fragmented and time-consuming for freelancers. The current system involves navigating complex rules, multiple softwares, and frequent updates about regulations and deadlines, leading to stress and confusion.

Product Solution: The Jupiter App offers an automated tax management platform that includes features like auto-calculation of tax liabilities, auto-filling of tax forms, and integration with local tax platforms. It also provides detailed expense tracking, tax optimization suggestions, and timely notifications for tax deadlines.

Market Potential: There are 27 million freelancers in the EU, indicating a large potential user base. The turnover from accounting services in the EU was 142 billion euros in 2020, with a significant portion from Portugal and Spain. Jupiter App targets reaching 200,000 users within five years, focusing initially on freelancers in Portugal and Spain.

Comparative Advantage: The app promises efficiency and cost-effectiveness, conducting tasks that typically take hours in mere seconds and at half the cost of traditional accounting services. It aims to replace the need for multiple tax-related platforms with a single, comprehensive solution.

User Feedback: Early feedback highlights the utility of the app in managing and staying updated with tax obligations, with features like a user-friendly dashboard and prompt updates on tax obligations being particularly appreciated.

Team and Advisors: The team includes experts with backgrounds in fintech, software development, and marketing, bolstered by advisors with significant industry experience.

Funding and Future Plans: Jupiter App is in the pre-seed funding stage, seeking €300,000 to extend its operational runway for 18 months, reach product-market fit, and significantly grow its user base and internal development team.

Elevate your brand with premier photography services in Portugal. Specializing in event, reportage, interior, portrait, and food photography, we capture the essence of your corporate events and business environments with precision and creativity. Our expert photographers ensure that every detail is showcased, providing you with compelling visuals that enhance your professional image and marketing endeavors.

🧩 7 Questions with Vânia Pinheiro Fortes

Q: What was the inspiration behind creating Jupiter App, especially focusing on tax automation for freelancers?

A: I've worked as an accountant on/off for almost 10y now. And did tax consultancy for freelancers, during my practice I noticed that they all had the same problem. That's where the idea to create Jupiter came from. I thought that adding tech to my accounting knowledge would enable me to do my job more efficiently. Then things evolved and now we're here.

Q: Can you walk us through how Jupiter App provides personalized tax calculations? What kind of data does it consider?

A: At the base is the portuguese tax code translated into code. We take in consideration all the personal data that may influence the personal income tax (eg: number of kids, marital status) and through integration with the tax authority we take the income and expenses.

Q: What kind of security measures does Jupiter App implement to protect sensitive financial data of its users?

A: Jupiter's database is inside a Virtual Private Cloud and is not directly accessible from the outside world. This gives us the garantee that the database access is strictly controlled by us. Furthermore, the data is encrypted at rest, giving us an extra layer of security. Users of our app will only be able to access their own data. We follow standard security practices and, for instance, never store user passwords and use encrypted connections. Jupiter integrates with several third-party API's, like Portal das Financas, Vendus, Moloni or InvoiceXpress - the user passwords to any of those external services are never stored on our side and, wherever possible, we use industry-standard protocols, like OAuth and, if not possible, we use API keys, which are encrypted when stored.

Q: Many freelancers worry about the accuracy of automated tools. How does Jupiter App ensure the reliability of its tax calculations?

A: We have the tax code at the basis of our calculation and pull info from reliable source aka efatura/tax authority. The other data is provided by the user (although we have plans to automate this too, in order to minimize errors) and are things that people don't mistake often (if they are married, the city they live in or how many kids they have). So the calculation are accurate 90% of the time, if not it's been human error.

Q: What are the unique features of Jupiter App that set it apart from traditional tax software and Excel sheets?

A: Automation, automation, automation. After onboarding, with 5 clicks or less we tell you your tax liability (social security, income tax, VAT).

Q: How does Jupiter App handle different tax jurisdictions, especially for freelancers who work with clients across various states or countries?

A: If the freelancer is a portuguese tax resident, which they must in order to take for advantage of Jupiter, it doesn't matter where the client is because again we have the tax code as our base. For invoicing for example, from a tax perspective it doesn't matter if you're client is Portuguese or foreign. We already take this into consideration when calculating your taxes.

Q: Looking towards the future, how do you see Jupiter App evolving to meet the changing needs of freelancers and the freelance economy?

A: More automation, still in the tax space but up a notch.

🎧 Music to go deep

Today we have a very special story. Before Serj Tankian became a powerhouse in the music world with System of a Down, he had a career that was more numbers than notes. He was once an accountant and even founded his own company "Ultimate Solutions" that specialized in creating accounting software. This venture aimed at simplifying financial management for businesses, offering a streamlined, user-friendly platform to manage accounts and finances effectively. Tankian's approach was innovative, reflecting his creative flair, aiming to reduce the complexities of financial operations and empower entrepreneurs and businesses to better understand and handle their financial landscapes. So we've collected a playlist of songs of System of a Down and Serj Tankian.

You can listen it on Spotify: Spotify Playlist

That's all for today! See you next week. And don't forget to check your email on Thursday — you'll find a regular Startupt.co newsletter with the most important news about startup industry in Portugal.

Have some news? Share with us (it's free!). Use this form.