-

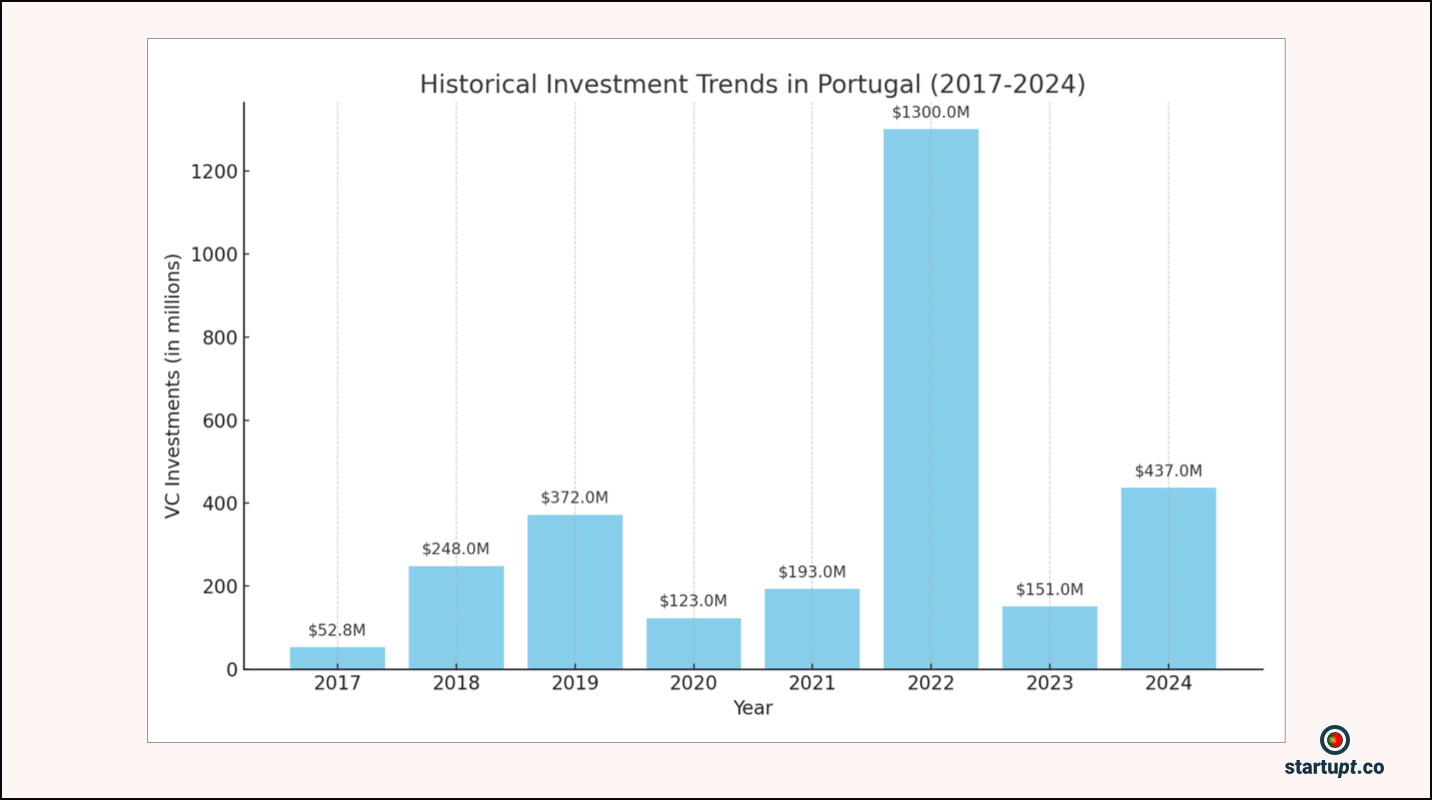

Venture capital slump persists in Europe as Portuguese funds struggled in 2023

The European venture capital landscape endured significant challenges in 2023, with investment volumes nearly halved compared to the previous year. Portugal was no exception, witnessing a steep decline in VC activity as funds across the continent faced growing headwinds

-

Portugal projected to reach $437 million in VC investments in 2024

The European venture capital (VC) landscape is experiencing a remarkable renaissance in 2024, characterized by substantial growth across various sectors and stages of investment.

-

Bernardo Tavares: If founders could “marry” a deep tech product with the go-to-the market strategy, would be really perfect

Bernardo Tavares, CTO at Granter.ai — is at the forefront of leveraging artificial intelligence to revolutionize funding efficiency for companies, optimizing incentives one at a time. With a strong focus on product and engineering, he drives tech strategy through a product-first approach, ensuring innovations are both cutting-edge and user-centric.

-

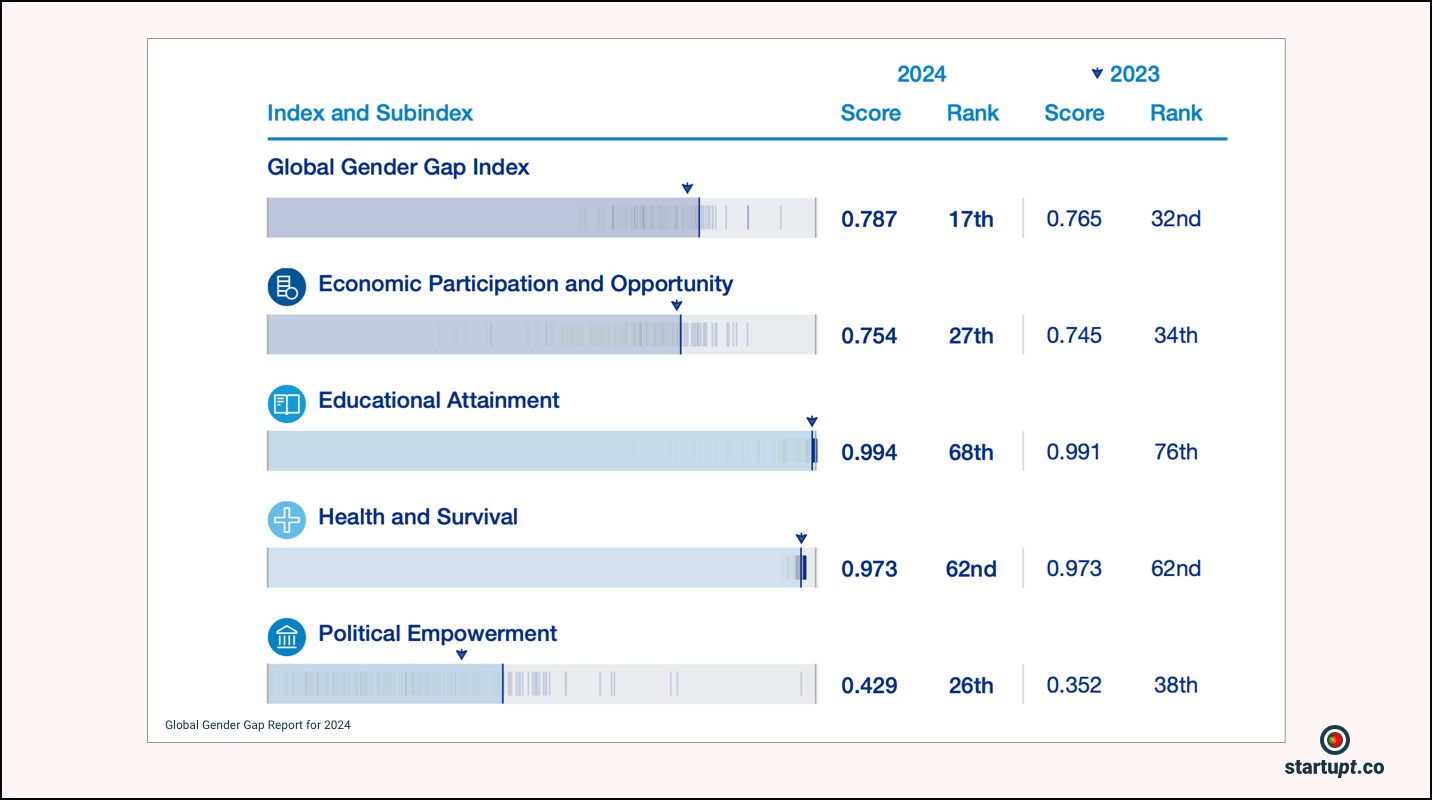

Report: Gender gap narrows, but funding disparity persists for women entrepreneurs

The latest Global Gender Gap Report for 2024, coupled with recent venture capital data, paints a mixed picture for women in business and entrepreneurship. While strides have been made in corporate leadership and professional roles, the startup landscape remains stubbornly uneven.

-

Cintia Mano: Portugal needs to become competitive in the incentives to early stage investors

Cintia Mano, CEO at COREangels discusses the challenges and opportunities in the Portuguese market, her investment criteria, and her vision for the future of venture capital.

-

Tocha: When we have people doing stuff, stuff happens

Interview with Tocha — Portugal-based entrepreneur, early-stage Angel Investor, Invest-Community Lead, Podcast host (Bitalk), creative villages builder and much more.